- Bitcoin price declined 8% and traded below USD 35,000.

- Ethereum broke the USD 2,400 level, XRP is down 11%.

- Multiple altcoins are down in double digits.

The whole crypto market once again followed the stock market and tumbled on Thursday as Russia’s president Vladimir Putin ordered a “special military operation” to protect the people of the Donbas separatist region in Ukraine, but said Russia will “aim for demilitarization and denazification of Ukraine,” per Bloomberg. It is estimated that Putin had massed 150,000 troops on the border. In a speech on Thursday, Putin appealed to Ukrainian soldiers to lay down their arms and go home. He said Russia doesn’t plan to “occupy” its southern neighbor, but that Russia must “defend itself from those who took Ukraine hostage” — the US and its allies who had crossed Russia’s “red line” with expansion of the NATO alliance, per the report.

US equity futures and stocks tumbled Thursday while bonds jumped and oil soared following the news.

Bitcoin trimmed all its gains this month and traded below USD 35,000. It is currently (04:24 UTC) down 8% and remains at a risk of more downsides below USD 35,000.

Similarly, most major altcoins are declining sharply. ETH is down 10% as it broke the USD 2,400 level while XRP dropped below USD 0.65. ADA is down 11% and might soon test the USD 0.80 support.

Learn more: Here’s How the Ukraine Crisis Might Impact Bitcoin and the Crypto Market

Total market capitalization

Bitcoin price

After a recovery wave above USD 38,000, bitcoin price faced sellers near the USD 39,250 level. BTC started a strong decline and broke many supports near USD 37,500. There was a move below the USD 35,000 level, increasing the risk of a move towards USD 33,500.

On the upside, the price might face resistance near the USD 36,500 level. The next key resistance is near the USD 37,500 level, above which the price might rise to USD 38,000.

Ethereum price

Ethereum price also followed a similar path and started a fresh decline below the USD 2,650. ETH even declined below the USD 2,500 support zone and is now approaching the USD 2,350 level. The next key support is near the USD 2,320 zone, below which the price might test USD 2,200.

On the upside, the price is facing resistance near the USD 2,550 level. The next key resistance is near the USD 2,650 zone, above which the price may perhaps test USD 2,720.

ADA, BNB, SOL, DOGE, and XRP price

Cardano (ADA) gained bearish momentum below the USD 0.85 support zone. It even declined below the USD 0.820 support zone. The price is now struggling to stay above USD 0.80. A close below USD 0.80 might spark a sharper decline towards USD 0.75.

BNB started a strong decline from well above USD 375 and dropped below USD 340. If there are additional losses, the price could decline toward the USD 332 support level.

Solana (SOL) is down 12% and trading below the USD 70 level. Any more losses could trigger a sharper decline towards the USD 65 level.

DOGE is gaining pace below the USD 0.122 support zone. If the bears remain in action, the price might decline towards the USD 0.112 level. Any more losses might set the pace for a move towards USD 0.105.

XRP price is also down 10% and trading below the USD 0.665 support zone. If the bears remain in action, the price could even decline towards the USD 0.62 support. The next major support is near USD 0.60.

Other altcoins market today

Many altcoins are down over 10%, including AVAX, DOT, CRO, WBTC, TRX, NEAR, UNI, ALGO, MANA, XLM, FTM, and BTCB.

Overall, bitcoin price is gaining bearish momentum and if it extends decline below USD 35,000, there is a risk of a sharper decline.

_____

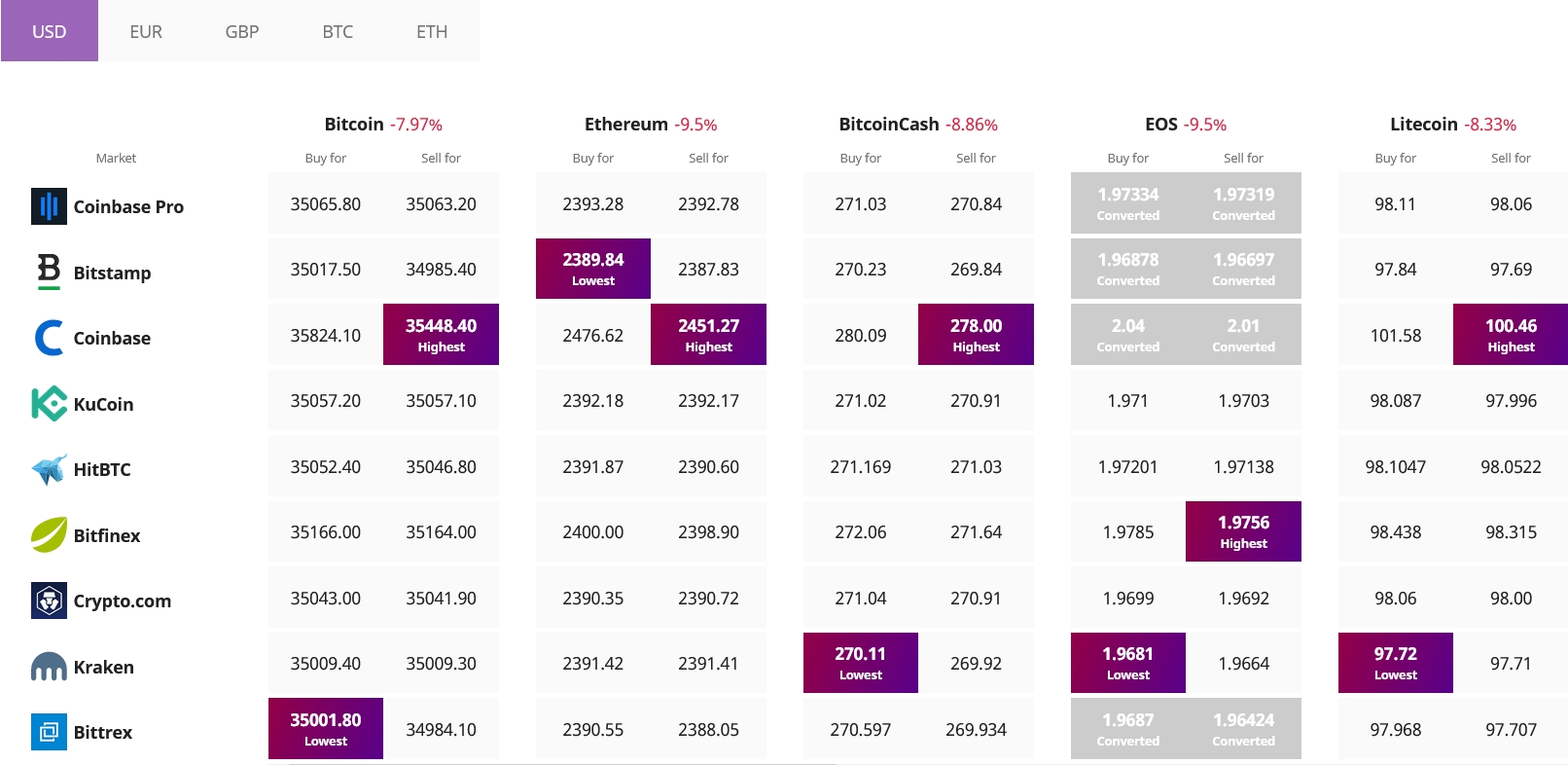

Find the best price to buy/sell cryptocurrency: