Bitcoin (BTC) mining difficulty has made another jump, hitting a new all-time high (ATH) – the third one in a row.

Further cutting into the miners’ profit margins, the mining difficulty (the measure of how hard it is to compete for mining rewards) just went up 4.78%, reaching almost 27.97 T.

Not only is this the first time the difficulty went into the 27 T level, not to mention nearly hitting the 28 T level, but it also marks another in a series of difficulty jumps to an ATH within the last six weeks.

Prior to this series of ATHs, the mining difficulty had hit its high back in mid-May last year of 25.05 T, dropping heavily right after. It took it months to surpass this level and start breaking records again.

Hashrate (the computational power of the network) has also been on the rise, hitting its own ATHs.

Since the previous difficulty adjustment two weeks ago, the 7-day moving average hashrate has increased 8%.

A higher hash rate is indicative of more miners securing the network by verifying the blockchain’s transactions.

Following the ban on BTC and crypto mining in China and the subsequent move of miners – therefore of hashrate – across the world, mostly to the US, the hashrate has recovered in just a few months, now hitting ATHs.

“This means that the number of miners has been growing even as some move out of China. This spike could be a result of miners finishing the migration of their farms from China to other countries and starting to operate again,” per crypto research firm Delphi Digital.

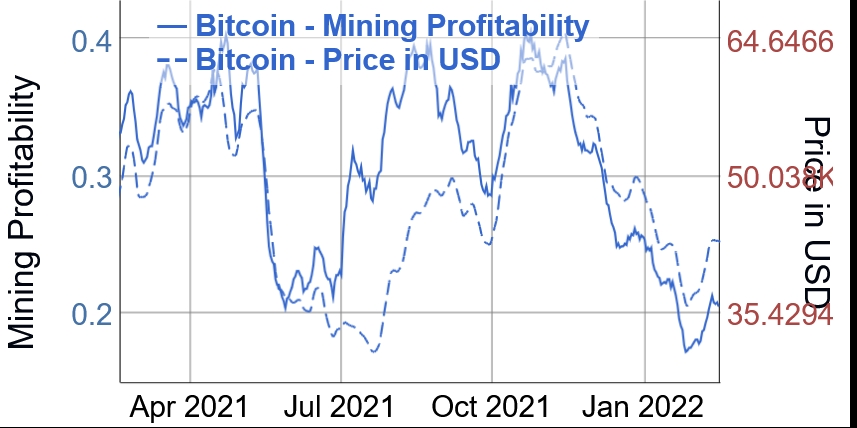

Meanwhile, Bitcoin mining profitability saw an increase as well, of 15% since the previous adjustment, as the price of BTC increased since then too. However, this profitability is still much smaller compared to what the miners could earn at the end of 2021.

At 11:00 UTC, BTC traded at USD 43,115 and was down almost 3% in a day and a week, trimming its monthly gains to less than 2%. The price is now down almost 13% in a year.

The mining difficulty of Bitcoin is adjusted every two weeks (or more precisely, every 2016 blocks) to maintain the 10-minute block time. The 7-day moving average block time on February 16 was 9 minutes.

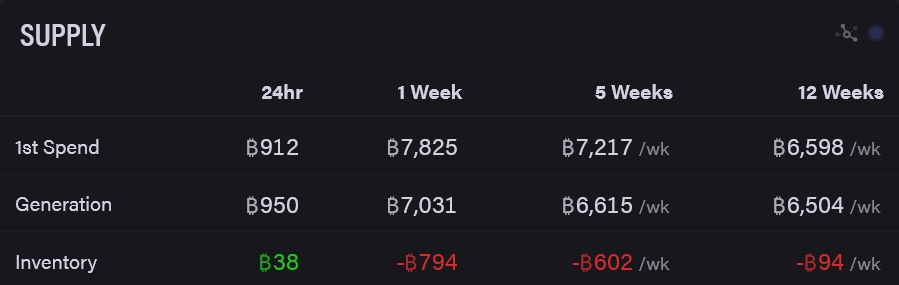

According to data provided by ByteTree, over the past several weeks, miners have spent more of their newly generated BTC than they held.

As previously reported, Bitcoin miners have been increasingly turning to creative methods to become more efficient, while also attempting to improve the image of the electricity-guzzling industry. For example, US oil giant ConocoPhillips decided to sell surplus flare gas from the oil- and gas-rich Bakken region to Bitcoin miners in North Dakota, while Norwegian Bitcoin miner Kryptovault plans to use excess heat from its mining machines to dry chopped wood used to heat homes.

____

Learn more:

– Bitcoin & Crypto Mining in 2022: New Locations, Technologies, and Bigger Players

– Analysts See Slower Bitcoin Hashrate Growth in 2022 Amid Market Correction

– Intel Confirms its Crypto Mining Plan

– Two Texans Use Flare Gas to Net USD 4M on Bitcoin Mining, Plan USD 20M in 2022

– Polish Miner Commercializes Tech Using Solar Panels To Mine Bitcoin, Heat Houses

– Hut 8’s ‘Ferrari of GPUs’ Ready for Ethereum’s PoS Move, Miner Open to M&A

– Bitcoin Mining CO2 Footprint Is Below 0.08% Of Global Total – CoinShares