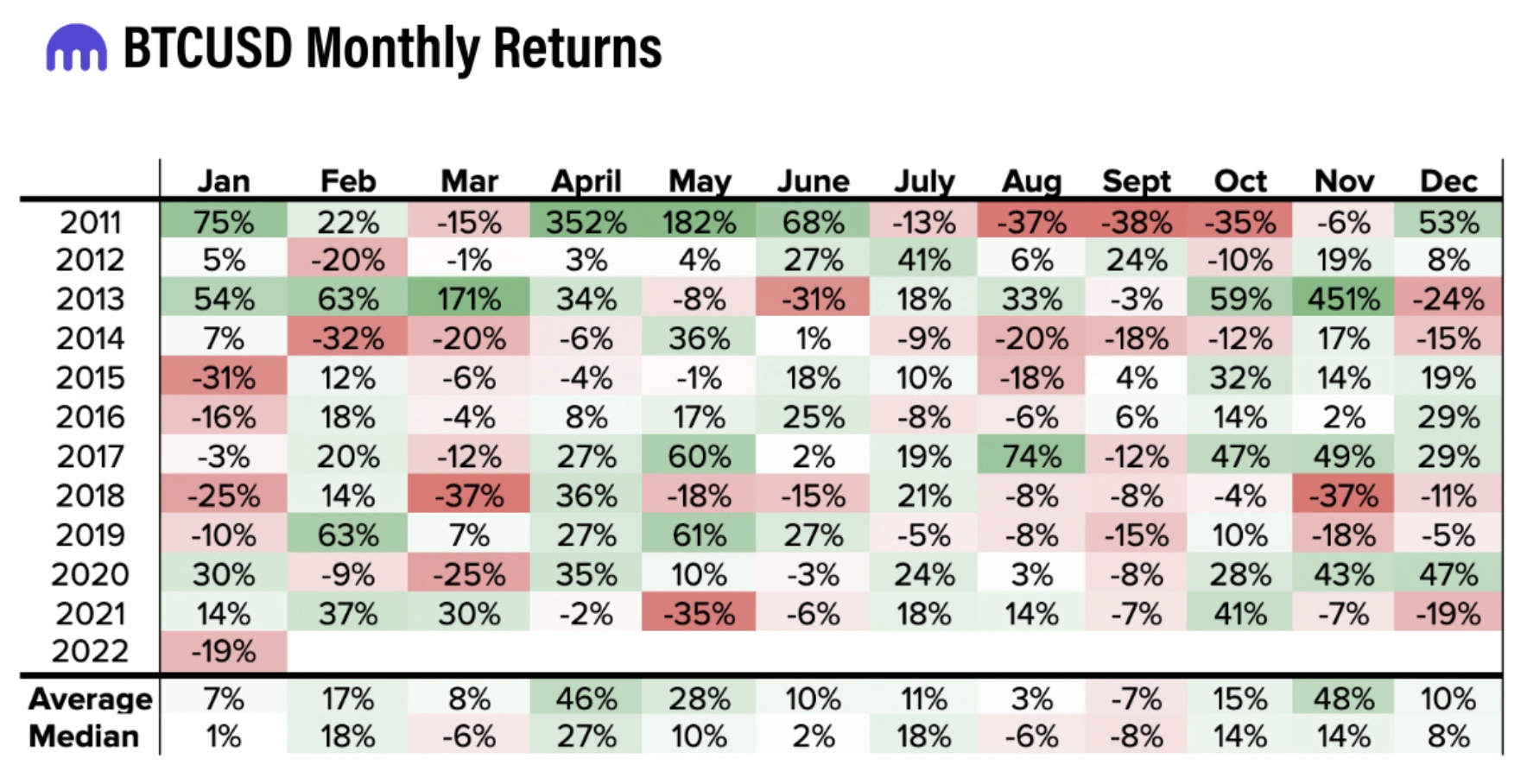

Despite January being the historically worst performing month for bitcoin (BTC), the coin’s -19% return for the month this year “did not live up to expectations,” crypto exchange Kraken said. But if history is a guide, February should be better for BTC investors, with average returns of +17% for the month, they added.

At 07:43 UTC, BTC trades at USD 44,930 after briefly touching USD 45,300. It’s up 5% in a day, 17% in a week and almost 8% in a month.

“January 2022 came in well below the average and median readings of +7% and +1%, respectively, for January monthly performance and marked the third worst-performing January on record when looking as far back as 2011,” Kraken said in its January 2022 Market Recap & Outlook report.

Looking at what February might bring for bitcoin, the report said that the month has historically been better than January. Bitcoin’s average return for the month of February is 17%, compared with an average of just 7% for January, Kraken’s report said.

February’s 17% average return makes it the fourth-best month historically for bitcoin, Kraken’s data further showed.

In addition to being a stronger month in terms of historical price performance, February has also exhibited less volatility on average over bitcoin’s history, the report noted. With average volatility of 83% per Kraken’s calculations, February is on average the fourth most volatile month, following January, April, and June.

January’s average volatility is 97%, with April and June coming in at 96% and 87%, respectively. The historically least volatile month is September with 61%, the report said.

Meanwhile, the report also pointed out that the number of bitcoin “whales,” defined as wallets holding more than BTC 1,000, fell from 2,153 wallets to 2,137 wallets during the month of January.

Given this fall, the report warned that the number of whale wallets has failed to reach a high of 2,168 from December last year, although the analysts admitted that this could also indicate that more demand is coming to the market later. Furthermore, it noted that the total number of BTC held by the whale wallets has increased over the course of the month, rising from BTC 7.916m to BTC 8.013m.

The increase in holdings suggests that some whales “opportunistically bought into last month’s weakness,” Kraken said.

In contrast to the situation for bitcoin, the report said that the number of ethereum (ETH) whales, defined as wallets containing more than ETH 10,000, rose from 1,157 to 1,163 during the month of January.

For ethereum, however, the total number of coins held by the whale wallets fell over the course of the month from ETH 81.286m at the beginning of the month to ETH 81.241m at the end of it. The fall in total holdings could indicate that the weakness seen for ETH in January was due to profit-taking among whales, Kraken suggested.

ETH trades at USD 3,177 and is up 3% in a day, 18% in a week, and almost 3% in a month.

_____

Learn more:

– Bitcoin Climbs Above USD 44K, Analysts See a Bull Long-term Too

– Bitcoin to Hit USD 93K This Year, According to Less Optimistic Survey

– USD 100K per Bitcoin ‘Hopium’ Now Moved to Mid-2022

– Bitcoin Is ‘Fundamentally Different’ From Other Cryptos, Unlikely To Be Replaced – Fidelity

– Fiat Fears Intensify as Turkey’s Inflation Runs Wild; Citizens Turn to Bitcoin, Tether

– Goldman Sachs Claims Adoption Won’t Boost Crypto Prices, Talks Down Stablecoin Plans