The US Federal Reserve (Fed) raised interest rates by 25 basis points today, marking the first rate hike in the US since before the COVID-19 pandemic. The increase was in line with what the central bank has long communicated to the market that it would do. (This is a developing story and is being constantly updated.)

“[…] the Committee decided to raise the target range for the federal funds rate to 1/4 to 1/2 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting,” the Fed’s announcement said.

The price of bitcoin (BTC) dropped immediately following the announcement, trading down by 1.3% to USD 39,900 in the first five minutes after the release of the Fed’s statement.

The increase in the interest rate was also widely expected by analysts, who have long argued that the Fed must raise rates in order to get the recently high inflation in the US under control.

Last month, inflation in the US reached 7.9%, its highest level since January 1982. The level is well above the Fed’s stated goal of keeping inflation at 2% per year “over the longer run.”

The decision today comes after Fed Chairman Jerome Powell told Congress earlier in March that the central bank would “proceed carefully” with its plan to hike interest rates this year despite the war in Ukraine.

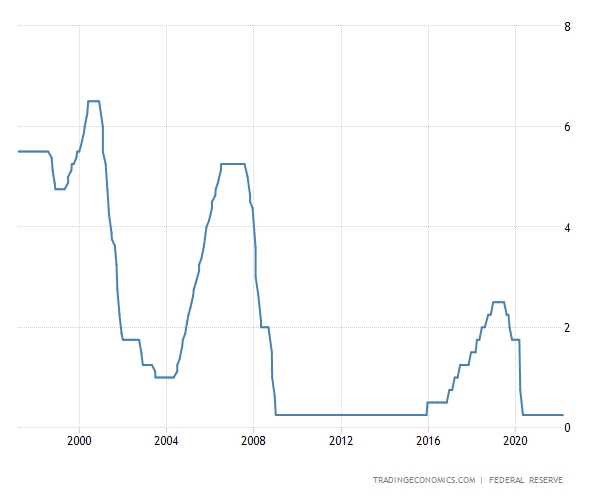

US Federal Fund Rate 25-year chart:

Before the war broke out, some economists expressed uncertainty as to whether the Fed would raise rates by 50 basis points at today’s meeting instead of 25, given the high level of inflation. With the war happening, however, a 50 basis point hike now appears unlikely, analysts say.

“If not for the geopolitical events, 50 basis points would certainly be on the table at this meeting,” Nathan Sheets, chief global economist at Citi, told the Wall Street Journal. “The one thing Powell can do is to hold out the prospect of 50 down the road,” he added.

Meanwhile, despite the Fed’s decision being widely expected by the market, Marcus Sotiriou, an analyst at digital asset broker GlobalBlock, said that volatility should still be expected.

He added that the announcement will provide more clarity as to whether the Fed “still plans on carrying out a slow and steady rate hike,” which he said, “will not shock the market.”

Similarly, Pankaj Balani, CEO of the crypto derivatives exchange Delta Exchange, also warned of increased volatility.

“We have seen interest to own the short term and medium-term volatility on BTC at the current levels and expect it to trade violently around the Fed meeting later today,” Balani said in an emailed comment.

Also, CEO of crypto consultancy Eight and popular trader Michaël van de Poppe said on Twitter that the first move will probably be “a fake-out move.”

The fake-out will be followed by “the real move, and then actually end up in a panic move overall,” van de Poppe predicted.

Commenting on bitcoin’s prospects as the Fed starts its tightening cycle, the crypto investor Mike Novogratz, who is the founder & CEO of Galaxy Digital, told Bloomberg TV that last year’s bitcoin rally ended largely because the Fed became more “hawkish.”

“I don’t think Bitcoin can rally aggressively until we get a pause,” Novogratz said, referring to the Fed’s rate hikes and emphasizing that “bitcoin is a narrative story.”

However, he also stressed that he is still a long-term bitcoin bull.

“Five years out, if bitcoin’s not at [USD] 500,000, I’m wrong on the adoption cycle,” Novogratz said.

_____

Learn more:

– Russia Sanctions Means Countries May Transition to Bitcoin Reserves – Pantera’s CEO

– Ukraine War Raises Questions About the ‘End of Monetary Regime’ and Role of Bitcoin

– Could the Ukraine Invasion Spark a Global Financial Crisis?

– Bitcoin, the Ukraine Crisis and the Central Bankers Dilemma